Are You a High-Income Professional Looking to Diversify Into Real Estate?

Discover How Data-Driven Investors Are Achieving 13.8% Annual Returns While Major Markets Struggle

Partner with our Asset Management Experts to unlock superior investment opportunities using our proprietary "Verify Your Assets" data analysis system.

Achieve Your Best Credit Score Yet

Tailored Credit Repair Strategies for Your Unique Needs

Expert Guidance to Navigate Every Step of the Process

Significant Boosts in Your Credit Score

Increased Confidence in Your Financial Future

Access to Better Loan Approvals & Lower Interest Rates

Take Back Control of Your Financial Future!

If you're looking to improve your credit score, our expert-backed strategies can help you achieve fast and meaningful results. With our guidance, you can rebuild your credit, access new financial opportunities, and enjoy lower interest rates.

WE CAN HELP

YOU WITH:

Late Payments

Collections

Foreclosures

Bankruptcies

Student Loans

Repossessions

Judgments

Medical Bills

Public Records

Hard Inquiries

ABOUT US

Over the last 9 years, we’ve mastered the art of restoring credit with clients achieving 200-point increases.

For the past nine years, we've helped clients restore their credit, often seeing increases of up to 200 points. We understand the frustration of being denied loans or homeownership due to past financial struggles. That's why we're committed to providing a second chance—helping you bridge the gap between where you are and where you want to be.

With years of experience and tested strategies, we’ve helped thousands of clients improve their scores—some within just 25 to 45 days. Our track record speaks for itself: 90% of our clients qualify for a home with lower interest rates, making homeownership more accessible and affordable.

We’re dedicated to helping you remove inaccurate negative items, rebuild your credit, and empower you with the knowledge to maintain financial success.

Here's How Real Property Management Partners Can Help You Build Wealth in Grand Rapids!

Superior Market Performance

13.8% Annual Appreciation vs. 7.4% in NYC

0.8% Vacancy Rate vs. 4-6% in Major Markets

Data-Driven Investment Analysis

"Verify Your Assets" 5-Year ROI Projections

Scientific Market Comparison Reports

Strategic Wealth Optimization

Complete Acquisition-to-Management Solutions

Out-of-State Investor Specialization

We’re currently accepting 5 new clients each month, so don't miss out on this opportunity to maximize your real estate investments!

Our Mission is Simple:

To Help High-Income Professionals Optimize Their Real Estate Investments with Data-Driven Asset Management, Superior Market Selection, and Analytical Precision.

Real Property Management Partners' Wealth Optimization Analysis Will Help You To:

Calculate True Investment Potential: We analyze rental revenue, vacancy rates, annual rent increases, and long-term appreciation using 5-year projections with scientific precision.

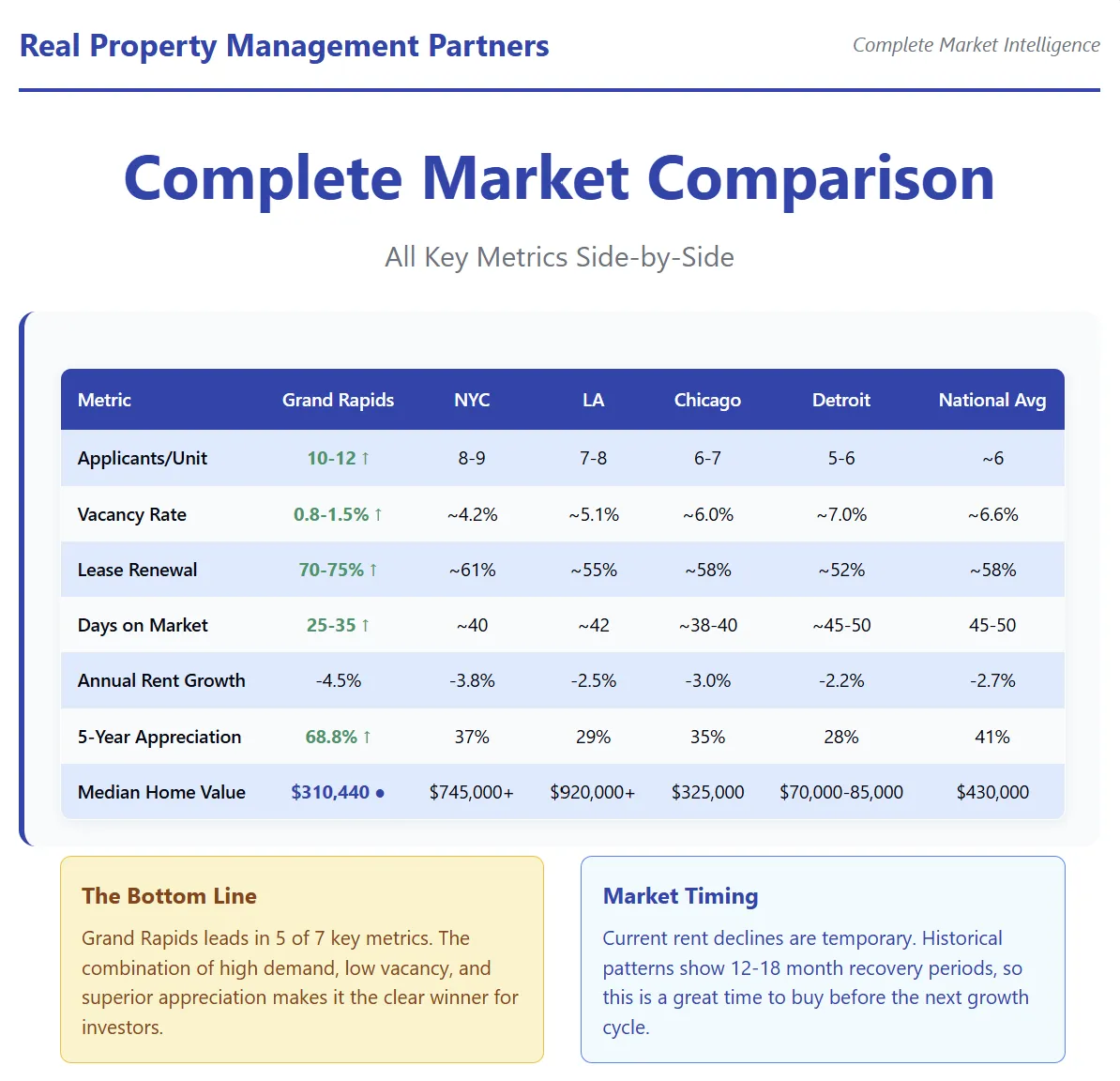

Compare Market Performance: See exactly how Grand Rapids properties outperform NYC, LA, and Chicago investments with our side-by-side analysis of key metrics.

Optimize Your Portfolio Strategy: We factor in operating expenses, tax benefits, depreciation, and debt reduction to show your complete ROI picture.

Understand Market Fundamentals: Total purchase costs, financing options, and cash-on-cash returns specific to Grand Rapids' superior investment climate.

LIMITED SEATS

Partner with Real Property Management to take a strategic approach to your real estate investments.

Let's work together to optimize property performance and build lasting wealth through data-driven decisions.

Trusted Asset Management Backed by Data Science

Led by Zach Proux, a Senior Data Science and Wealth Management expert, our team combines Fortune 500 analytical expertise with deep real estate knowledge. Unlike traditional property managers, we bring corporate-level data analysis to real estate investing.

Our proprietary "Verify Your Assets" system and highly trained, responsive team help high-income professionals, investors, and institutions maximize returns and protect their investments in Grand Rapids' explosive growth market.

How We Do It

01

Investment Analysis

We start by analyzing Grand Rapids opportunities against your current market: comparing income potential, expenses, equity growth, tax advantages, occupancy rates, and long-term appreciation.

02

Verify Your Assets" Report

Using our proprietary data science tools, we create a comprehensive 5-year projection showing your property's ROI potential with institutional-level precision.

03

Strategy Meeting & Scenario Planning

We meet with you to review the findings and set clear wealth-building goals for the next 1, 5, and even 10+ years. Then, we'll walk through "what-if" scenarios so you can understand how market changes might impact your investment.

04

Monthly Performance Reporting

Each month, you'll receive detailed reports with updates on cash flow, rent collection, vacancies, financial statements, and market performance vs. projections.

05

Year-End Projection Updates

In the 4th quarter, we revisit your assumptions and provide updated year-end financial projections based on current market data.

06

Annual Wealth Optimization Review

At the beginning of each year, we meet again to review your complete investment performance and create a new wealth-building action plan for the year ahead.

LIMITED SEATS

What Data Driven Investing & Combine ROI Can Do For You & Your Real Estate Portfolio:

Data-driven real estate investing goes beyond simple cash flow analysis. Our "Verify Your Assets" system tracks four key profit drivers:

Cash Flow: the income left after all expenses and management fees

Appreciation: Grand Rapids delivers 13.8% annual appreciation vs. 7.4% in NYC and 5.8% in LA

Debt Reduction: the equity you gain as tenants pay down your mortgage

Tax Benefits: deductions like depreciation, interest, and even tax-free growth through 1031 exchanges

Unlike traditional investments like index funds (which typically yield 8-12%), Grand Rapids real estate often delivers combined ROIs of 30%, 40%, or even 50%, thanks to superior market fundamentals and leveraged growth.

Why Choose Real Property Management Partners?

✅ Data Science Leadership: Zach Proux combines Asset Management Expertise with Senior Data Science Experience at a Fortune 500 Company

✅ Licensed Realtor Partnership: Complete acquisition-to-management solution

✅ Proprietary "Verify Your Assets" analysis system

✅ Specialized focus on out-of-state investor success

✅ Corporate-level analytical precision applied to real estate

LIMITED SEATS

TESTIMONIALS

Our Clients Speak For Us

Not only are they quick to respond, but they’re also the only property management company I’ve worked with that’s truly proactive. Their communication is clear and consistent, which is one of the top qualities I look for in a management team. I’ve honestly adjusted my investment strategy to focus on this city just because of how happy I’ve been with their service and partnership. Highly recommend!

Elan Adler

Real Property Management Partners have truly been the best partner for us as we are first-time landlords. They accepted our naïve questions, not making us feel foolish. They made sound recommendations when we were confounded. They even stepped in to fix and ameliorate situations when other professionals didn't hold up their responsibilities. Our rental is in another state, so we were not sure how this would all go - we honestly couldn't be happier with their service.

Thomas Van Soelen

Fantastic Property Management company. The communication is top-notch. Especially for tenants and owners that's exactly what you need. I'm also referred multiple other investors too this property management company and they all say the same.

Ryan Prichard

LIMITED SEATS

At Real Property Management Partners, We Go Beyond Basic Management - We Offer Investment-Grade Asset Management with Data Science Precision!

LIMITED SEATS

Frequently Asked Questions

What is the difference between property management and asset management?

Property management focuses on day-to-day operations such as tenant screening, rent collection, maintenance, and lease management. Asset management, on the other hand, involves strategic oversight to maximize the property's long-term value and return on investment.

This includes financial analysis, capital improvement planning, and aligning property performance with investment goals.

What is the Wealth Optimizer service?

The Wealth Optimizer is a proprietary tool provided by Real Property Management that offers a comprehensive analysis of your property's financial performance. It helps in understanding revenue, expenses, equity changes, tax deductions, and more.

Is the Wealth Optimizer suitable for multiple properties?

Absolutely. The tool is designed to handle analyses for multiple properties, allowing you to compare and evaluate each asset's performance within your portfolio.

How does asset management help in planning for capital improvements?

Asset management involves forecasting and budgeting for significant expenses such as roof or HVAC replacements. By anticipating these costs based on the property's age and standard life spans, investors can avoid unexpected financial burdens and maintain property value.

How can I get started with the Wealth Optimizer service?

To begin, you can request an assessment through Real Property Management Partners' website. We’ll initiate the process with a comprehensive analysis of your property and set up meetings to align on investment goals.

Take Back Control of Your Financial Future!

If you're looking to improve your credit score, our expert-backed strategies can help you achieve fast and meaningful results. With our guidance, you can rebuild your credit, access new financial opportunities, and enjoy lower interest rates.

STILL NOT SURE?

Frequently Asked Questions

Can anything be removed from my credit report?

Under the Fair Credit Reporting Act (FCRA), inaccurate, outdated, or unverifiable items may be eligible for removal. If an item meets these criteria, we can dispute it on your behalf.

How long does the process take?

Results vary, but clients have seen improvements of up to 200 points within 25 to 45 days.

Do you offer monthly subscription plans?

No. Our goal is to resolve your credit issues as efficiently as possible—without unnecessary delays or prolonged fees. We focus on getting results quickly and effectively.

What happens after I sign up?

We take care of everything! Our team works directly with credit bureaus to dispute inaccuracies while you sit back and watch your score improve.

Do you offer payment plans?

Yes! We offer flexible payment plans ranging from 4 to 8 installments. Plus, if you add a spouse, you’ll receive a 25% discount.

Can removed items return to my credit report?

Typically, once an item is removed, it does not return. If a previously deleted item is reinserted, credit bureaus are required to notify you. If that happens, we will assist you in disputing it again.

Copyright © 2025. All Rights Reserved.